Hard Money Atlanta Can Be Fun For Anyone

Wiki Article

The 7-Second Trick For Hard Money Atlanta

Table of ContentsFascination About Hard Money AtlantaNot known Incorrect Statements About Hard Money Atlanta Hard Money Atlanta Can Be Fun For AnyoneThe 6-Minute Rule for Hard Money Atlanta

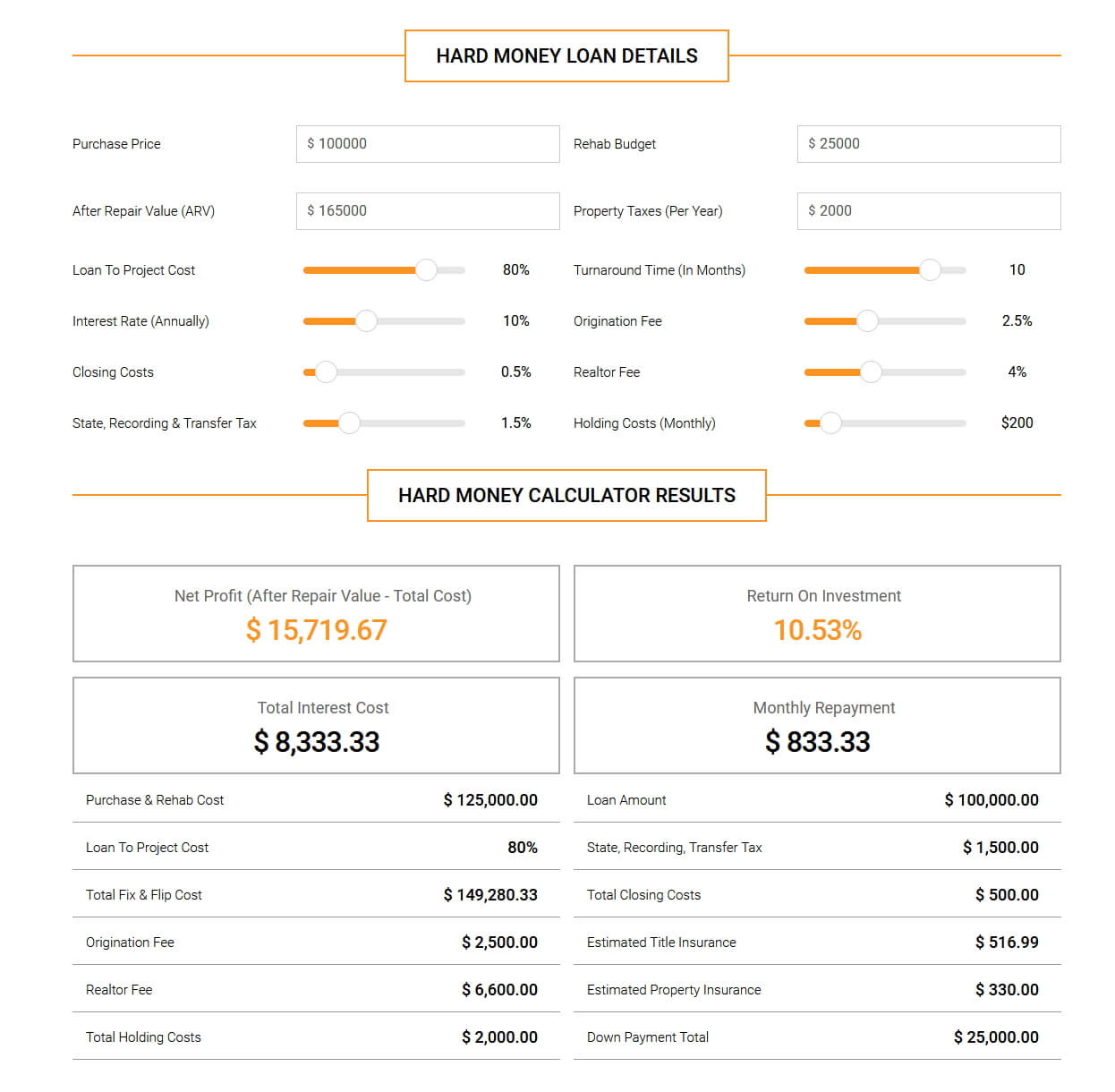

In the majority of areas, rates of interest on tough cash fundings run from 10% to 15%. Additionally, a customer may need to pay 3 to 5 points, based on the total lending quantity, plus any applicable evaluation, assessment, as well as management fees. Numerous difficult cash lenders call for interest-only repayments throughout the brief period of the lending.Hard cash loan providers make their cash from the rate of interest, factors, as well as fees credited the customer. These lending institutions seek to make a quick turnaround on their financial investment, hence the higher rate of interest as well as shorter terms of tough money car loans. A hard cash funding is a good suggestion if a debtor needs cash rapidly to buy a building that can be rehabbed as well as flipped, or rehabbed, leased and re-financed in a relatively short time period.

They're likewise helpful for investors that don't have a great deal of collateral; the home itself ends up being the security for the lending. Tough money lendings, nevertheless, are not ideal for traditional property owners wishing to finance a building long-term. They are a beneficial device in the financiers toolbelt when it comes to leveraging cash to scale their company.

For personal capitalists, the most effective part of obtaining a hard money financing is that it is simpler than getting a standard home mortgage from a bank. The approval process is normally a lot less extreme. Financial institutions can request for a practically unlimited collection of records and take several weeks to months to get a financing approved.

Getting My Hard Money Atlanta To Work

The major objective is to see to it the borrower has an exit strategy and isn't in economic destroy. Yet lots of tough cash lenders will certainly function with people that do not have excellent credit rating, as this isn't their most significant concern. The most crucial thing difficult money lending institutions will consider is the financial investment home itself.They will likewise evaluate the debtor's scope of work as well as spending plan to guarantee it's reasonable. Occasionally, they will quit the procedure since they either think the home is too far gone or the rehabilitation budget is impractical. They will review the BPO or assessment and the sales and/or rental comps to guarantee they concur with the evaluation.

However there is an additional benefit built right into this process: You get a second collection of eyes on your offer and also one that is materially invested in the task's end result at that! If an offer misbehaves, you can be fairly positive that a tough money lending institution will not touch it. Nonetheless, you must never ever make use of that as an excuse to forgo your own due diligence.

The ideal area to seek tough cash loan providers remains in the Bigger, Pockets Difficult Cash Loan Provider Directory Site or your neighborhood Property Investors Organization. Bear in mind, if they have actually done right by one more financier, they are most likely to do right by you.

Hard Money Atlanta Can Be Fun For Anyone

Review on as we review difficult cash car loans and why they are such an eye-catching choice for fix-and-flip investor. One significant benefit of difficult money for a fix-and-flip investor is leveraging a relied on lender's dependable resources and speed. Leveraging methods utilizing other individuals's money for financial investment. Although there is a threat to financing an acquisition, you can maximize your very own cash to purchase even more residential or commercial properties.You can handle tasks incrementally with these strategic fundings that permit you to rehab with just 10 - 30% down (depending on the lending institution). Hard cash car loans are commonly temporary finances made use of by investor to fund repair as well as flip residential properties or various other real estate financial investment deals. The residential or commercial property itself is utilized as security for the loan, and the high quality of the realty deal is, as a result, more vital than the borrower's creditworthiness when qualifying visit their website for the funding.

This also implies that the risk is higher on these lendings, so the interest rates are normally higher as well. Repair and flip capitalists pick difficult cash due to the fact that the marketplace doesn't wait. When the opportunity offers itself, and also you're all set to get your task into the rehab stage, a difficult money funding gets you the cash straightaway, pending a reasonable evaluation of the service offer.

Hard Money Atlanta Things To Know Before You Get This

Intent as well as property documentation includes your comprehensive range of job (SOW) and also insurance. To evaluate the residential property, your lending institution will certainly consider the worth of equivalent homes in the location as well as their forecasts for growth. Complying with a quote of the residential property's ARV, they will certainly fund an agreed-upon percent of that worth.

Report this wiki page